3 reasons for marketers to resist the call to cut prices

The latest statistics on online fashion retail sales, research on the main purchase driver for financial advice and a Californian think tank pricing model all give marketers strong reasons to reconsider Price as a useful tool.

Evidence 1: Online fashion sales prove price not the motivator

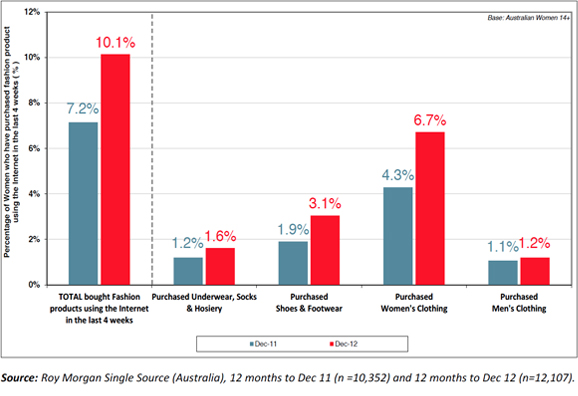

No wonder Australian retailers are scared of online stores. British online retailer ASOS recently revealed that Australia is its single largest foreign market — with Australians buying something from the ASOS website every 6 seconds. The latest research from Roy Morgan shows at December 2012, 7.6% of Aussies aged 14+ (or 1,430,000 people) had made an online fashion purchase in any given four weeks — up from 5.7% (1,062,000) one year earlier.

Online fashion-purchasing habits by Australian women by sub-category, 2011-2012

What is really interesting is the opportunities for marketers this research reveals. Most people would probably jump to the conclusion that these online sales are being lost by Australian stores because clothes are available cheaper from overseas. Everything on the web is cheaper, right? Well actually, no.

Roy Morgan’s research has found “scoring a bargain is not the main motivation for women purchasing fashion products online. Far more important is quality, with 75% of them agreeing with the statement ‘I believe quality is more important than price’.”

Discretionary spending by women on clothes has parallels with the way men seek financial advice. A recent national survey by an independent network of financial advisors found the vast majority of customers were more concerned about the quality of service and the frequency of face-to-face time they received than the size of the fee. Of hundreds of customers surveyed, price was rarely mentioned. Value was the primary concern, and the value equation was grounded in the perception of the quality of advice. .

None of this is new. I’ve been segmenting customers using the New Economic Order for nearly two decades since it was first developed by two Australian academics.

Evidence 2: choose who you want to be your customer

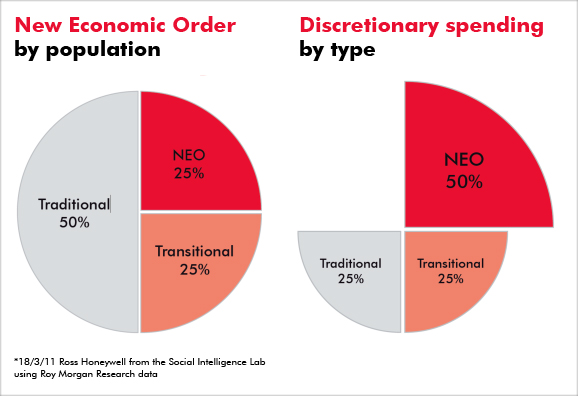

You can segment the population by three distinct sets which allow marketers to predict discretionary spending behaviour. The biggest segment, the Traditionals, sre generally cash poor with most of their spending accounted for with essential services, utilities bills, rent, transport and food. They have neither the capacity nor the predisposition to purchase discretionary items.

The other half has a common mindset, they share a desire to buy quality goods and experiences. This group is divided in half by their capacity to spend, one half are NEOs, and while they are only a quarter of the population they represent half all discretionary spending. Transitionals are NEOs on a limited budget: a career couple with one at home with a baby, or a high achiever that's just started their own business, or perhaps they have retired.

For 50% of consumers, the Traditionals, a cheap price is their opening and closing consideration. However these are the people who don’t spend much. They also deliver no sense of loyalty and don’t refer new customers. Every sale to a Traditional is a new sale that starts from scratch. And risks going to the lowest priced competitor on the day.

Most restaurant and airline customers and B2B purchasers are NEOs. These people research purchase decisions on the basis of what they believe are the features and benefits that mean the most to them. Price comes LAST, and isn’t much of a deal breaker.

Those latest stats on online fashion sales make sense in light of NEO behaviour. NEOs are online researching what’s hot in the world of fashion. In fact, it’s where they do most research when considering any major purchase because it’s where they control the levers, avoiding the unsavoury hassle of being sold by a salesman face to face. While Traditionals continue to spend the majority of their clothing budget on essential items like socks and undies in stores when the sales are on, NEOs continue to buy more discretionary fashion items, more often, both from the Internet and instore.

So what’s the best marketing model for selling to NEOs?

Evidence 3: all value is subjective

According to Ron Baker, the founder of Californian think tank the VeraSage Institute there are two fundamental approaches to pricing:

Cost-Plus Pricing

Labour Theory of Value

Product » Cost » Price » Value » Customers

Pricing On Purpose

Subjective Theory of Value

Customers » Value » Price » Cost » Product

You can see how subjective value pricing turns the order of cost-plus pricing on its head, by starting with the ultimate arbiter of value – the customer. In Baker’s words: “Goods and services do not magically become more valuable as they move through the factory and have costs allocated to them by cost accountants. The costs do not determine the price, let alone the value. It is precisely the opposite; that is, the price determines the costs that can be profitably invested in to make a product desirable for the customer, at an acceptable profit for the seller.”

As a marketer, for decades I found software one of the simplest products to approach from the Pricing On Purpose model; it’s the only reason Microsoft had education, standard and professional versions. The mid range product best reflects a fair margin for the cost of production of the product. The same product is then also sold at a low entry price with a few features turned off to maximise sales volume at the low end and repackaged in a fancy big box with a few extra features to maximise margin at the upper end of the market.

Choose who you want your customer to be, only then pick a marketing P

Whether you are selling clothes or cars, fair trade coffee or boutique wine, building materials or investment services, remember when your sales force wants you to discount, ask them to stop and think about the customer. Are you selling a basic product to a student, an authentic experience to a Transitional or a professional service to a NEO? Agree with sales who your customers are before you decide to use the PRICE lever.

Depending on who your customer is, Product, Place or Promotion may be more valuable to them than Price.

Scan the QR code for our contact details.

Download the Neoreader app.

© COPYRIGHT 2013 UNO marcomms Privacy