Get onboard the online retail bandwagon: $14.9bn & racing

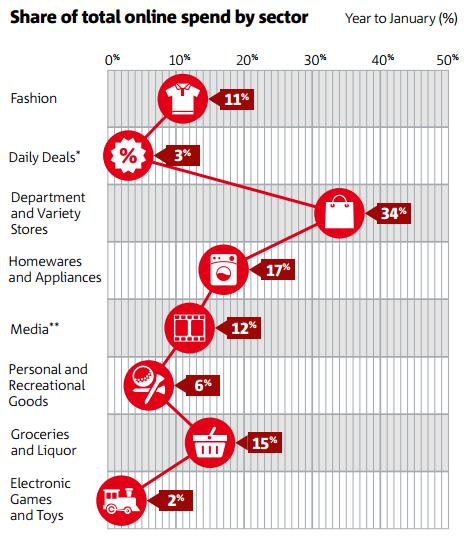

The idea that online retail is about discounts isn't in line with the facts. While margins might be tighter, e-commerce is no longer just about bargains and end-of-line clearances. The latest NAB Online Retail Sales Index shows just how broad Australian retailing has become. Daily Deals sites are stuck at 3% share. The biggest online sales growth stories now are in liquor and groceries.

Department stores and appliance retailers the big winners, or losers online?

The mainstreaming of e-commerce can be seen in the leadership of department store products with a whopping one third of online spending. Once slow to adopt, Myer now offers 119,000 individual products online.

Domestic operators still have the lion’s share of online sales at around 75%. Gerry Harvey’s call for a GST on foreign online sales is just noise when you consider he mostly sells homewares and appliances, the second largest online category. I don’t see Australia Post delivering washing machines bought from Best Buy New York via their online store as a threat to Gerry. The threat is internal, his stores are failing to add value to the sales process and Harvey Norman still doesn't appear to have a strategy to compete with local online challengers.

Challenger brands have an advantage online

If anything, e-commerce puts the power back into the hands of customers who want to deal direct with manufacturers. Australian challenger brands, when they make a product that locals actually want, can cut out the blood sucking Coles/Woollies duopoly and the Gerry Harvey’s.

When brands reinvest into marketing a portion of the retailer margins that going online cuts from the delivery chain, they can grow share long term. This way e-commerce becomes a WIN, WIN equation for brand and customer.

An example of this approach is the transformation of a traditional Australian designer manufacturer of compression and sportswear – Quick Response. UNO has helped them transform from a wholesaler at the mercy of retailers to a direct-to-consumer e-business. This challenger brand is now competing with SKINS, (the retail market leader with a high priced foreign made product), by offering superior Australian made garments direct online, at a better price. Check out the QRS compression online store.

The future for online retail marketing

While retail sales generally have been mostly flat, ABS figures show Australian’s spent 27% more online in the year to March than the year before.

The NAB online spend index doesn’t include online shopping paid for by Paypal, transfers or EFTPOS, so the 6.5% of all retail spending measured in the latest report to March 2014 is an underestimate of the reality. Marketers need to view online retail as a growing opportunity for current business growth, not just a nice to have in the future.

Source: National Australia Bank Online Retail Sales Index.

Scan the QR code for our contact details.

Download the Neoreader app.

© COPYRIGHT 2013 UNO marcomms Privacy