Obstacles to innovation: A jeweller’s tale

Have you read the retail sector is finally looking up? Unfortunately not for everyone.

A friend of mine is one of Australia’s leading luxury jewellers. This year his turnover is down 20% and the word in the trade is over two dozen high-end jewellers around Sydney are on the brink of closure. That’s a lot in such a niche category. What has served them well for decades has seemingly evaporated overnight.

Where have the sales gone? A few years ago no-one had heard of Pandora as a brand of jewellery. Australia is now Pandora's fouth biggest market in the world. Or have you heard of The Iconic as a place to shop for fashion? Last week The Iconic turned over $1,000,000 of online sales in one day.

The simple answer for retail is to go online, right?

My jeweller’s quandary is he opened an online store with a similar offer to his shop and failed to gain any incremental growth.

Global changes demand an innovative response

It’s not just small high-end jewellers suffering from change. The global super premium brands are suffering the curse of ubiquity, Louis Vuitton sales are plummeting despite the increase in purchases of luxury goods by the emerging Chinese millionaire class.

We are increasingly seeing fashion conscious style setters seeking designs from unknown startups, boutique designers that they can tell friends they’ve discovered. Being in the know has more credibility with peers than wearing what any person with a Platinum card can buy in any Gucci store, from Guangzou to Fifth Avenue, Sydney to Roppongi.

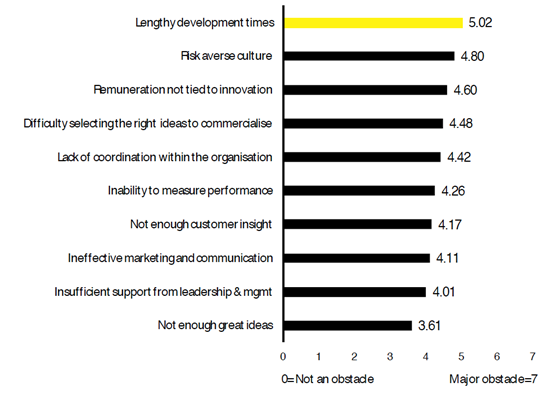

Big brands have difficulty innovating as they have an aversion to cannibalising their existing business. It becomes harder the bigger and more established you are, which fortunately gives Australian challenger brands an advantage. The barriers to innovation have been identified in a Australia wide research by the Australian Institute of Management:

What’s stopping Australian businesses innovating

My friend said he had come across an offshore maker of silver jewellery, gold plated with semi-precious stones that look amazing but only retail for $300 to $500. His fear is if he stocked them no-one would continue to pay $3,000 to $5,000 for his similar looking existing product.

My suggestion to my jeweller friend is to take advantage of his ability to be more nimble than a Tiffany. He isn't facing the number one barrier to innovation, a lengthy development time and there is a way he can try something new with minimal risk. If he quickly sets up a small online store under a different brand, he then has no reputation to lose and can test the appetite for this new product.

The ability to test the mix of product and price is easily done with an online store. I’ve written in the past about how we can learn from fashion retailers that are innovating for pricing advantage.

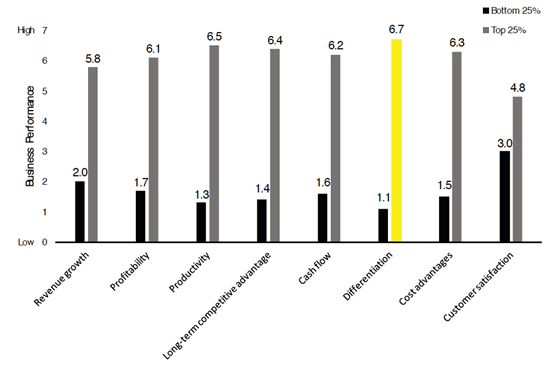

The study shows the upside to trying new ways by becoming an innovator in your category is huge.

Innovation leaders Vs laggers: business performance ratings.

Innovation leaders are two to three times more successful than innovation laggers in terms of growth, profitability, productivity and cash flow. Risk obviously has greater rewards than business as usual. One UNO case study proves the point, Butterfly Silver was the first Australian Jeweller to apply a fashion forward procurement model to become a successful challenger brand.

Source: University of Melbourne and the Australian Institute of Management. 2013

Scan the QR code for our contact details.

Download the Neoreader app.

© COPYRIGHT 2013 UNO marcomms Privacy