Perception or Reality? Customers now decide

Over 50% of people don’t trust financial advisers. So I was told on the news last night. If you have ever been to see an advisor you’ve probably come away with the perception that they aren’t telling you everything straight. Commbank’s multi-million dollar financial planning scandal has proved perception IS reality when it comes to advisors.

For decades when a business advertises a product, whether baked beans or an investment, the words and claims made are open to scrutiny and have to be THE TRUTH. You have to deliver on the promise or you are liable under a number of ad standards, ASIC and ACCC rules. If you sell a financial product face-to-face most of these rules don’t seem to apply or be enforced.

Big 4 Banks still traditional marketers

What the big 4 banks and AMP have got away with is a classic exercise in traditional marketing methodology – control the distribution channel and you control both pricing and product. By using different brands they have been able to sell the same products to an unsuspecting public. Most people haven't realised 80% of advisors work for groups owned or aligned with just 5 product providers.

Most people think they are seeking financial advice, when what they are getting is a sales pitch. How can anyone be given genuine choice when of 18,000 advisors only 31 are truly independent? We’ve all been buying Home Brand super for years and haven’t known it. Here is a list of just some of the hundreds of “brands” just 5 providers have sold their own products under:

Cavendish AMP

Charter Financial Planning AMP

Garrisons AMP

Genesys AMP

Hillross Financial Planning AMP

Ipac AMP

Avanteos Commonwealth Bank

Colonial First State Commonwealth Bank

Commonwealth Financial Planning Commonwealth Bank

Count Financial Commonwealth Bank

Financial Wisdom Commonwealth Bank

Witaker McNaught Commonwealth Bank

Apogee NAB

Garvan Financial Planning NAB

Godfrey Pembroke NAB

Lend Lease Financial Planning NAB

Meritum Financial NAB

MLC NAB

Elders Financial Planning ANZ

Financial Services Partners ANZ

Millenium3 ANZ

OnePath ANZ

RI Advice (RetireInvest) ANZ

Sentry ANZ

Asgard Westpac

BT Westpac

Pact Accountants Investment Group Westpac

KPMG Financial Planning Westpac

Securitor Financial Group Westpac

A couple of rogue CommBank advisors who ripped off investors for millions is just the tip of the iceberg of poor brand values. Ian Narev says the business won’t suffer. I suggest the era of brand equity built upon decades of million dollar perception-shaping advertising is over. The Internet has democratised the share of mind of customers. Does Narev not understand this? Instead of changing his business model he returned from holidays to push the button on a million+ dollar ad campaign trying to reassure customers they are fixing things. This old school reaction won't preserve brand equity long term. Here’s proof.

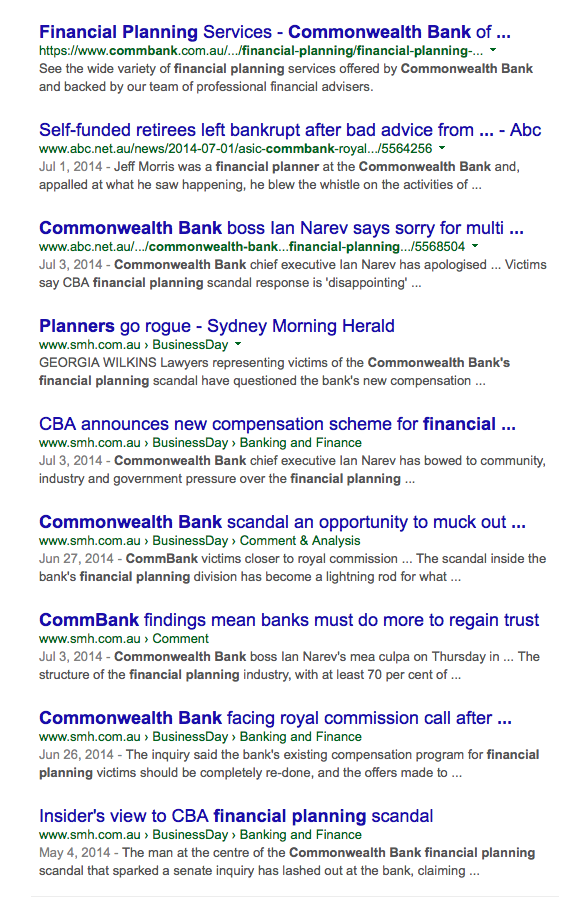

Try Googling CommBank financial planner. This is the result I got:

Last week we saw the government roll back the FoFA laws that were supposed to make hidden and trailing commissions illegal. Despite some wordy amendments from Clive Palmer, there is still no ironclad law that insists advisors can’t sell you a product because they get a kickback, not because it’s the very best choice for you.

Challenger brands will win with customer centric marketing

Legislation may not stop the consumer unfriendly practices of big banks. Social media and the empowered consumer will. And new technologies will see challenger brands that build financial product and service offers around what customers actually want will grow at their expense. Coles new deal with GE Capital to offer loans is just the start. I'll leave the last word to a consumer active on social media:

Scan the QR code for our contact details.

Download the Neoreader app.

© COPYRIGHT 2013 UNO marcomms Privacy